Scared? 6 safe companies beat U.S. bonds

The beat-down in stocks is creating an interesting opportunity in a chance to invest in rock-solid companies that pay out more than U.S. Treasuries.

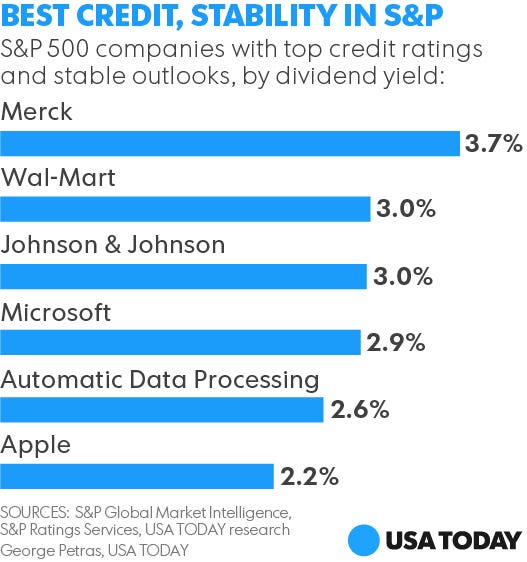

There are now six stocks in the the Standard & Poor's 500 index including healthcare giant Johnson & Johnson (JNJ), software maker Microsoft (MSFT) and gadget maker Apple (AAPL) that have perfect or near-perfect credit ratings and are paying dividend yields that top the yield on the 10-year Treasury note, according to a USA TODAY analysis of data from S&P Global Market Intelligence. The companies must have a AAA, AA+ or AA rating from Standard & Poor's Ratings Services in addition to a stable credit outlook. So the list only has the most stable companies.

Stock prices have been pummeled to such a degree and bond yields pushed down so much that investors can pick up the most financial surefooted companies and get dividend yields that surpass the 1.75% yield on the 10-year Treasury. These six companies are currently yielding an average of 2.9%.

Johnson & Johnson is perhaps the best example. The health products company is just one of three companies left in the S&P 500 that have the perfect AAA credit rating from S&P Ratings Services and a stable outlook. Despite that rock-solid rating, the company's stock is yielding 2.9% a year. This company has an added bonus is in that it's in the relatively stable health-care business. The stock is only down 1% this year while the S&P 500 is off nearly 9%. J&J is only 3.5% from its 52-week high in fact, while the market is down 12.5%.

Exxon Mobil nearly stripped of AAA rating

Microsoft is the another remaining AAA-rated company with a stable outlook, and it's yielding 2.9%. The cloud-technology company's enormous pile of $113 billion in cash and investments, as well as its relatively low debt, gives investors good reason for confidence in its financial strength.

It's important to note that while these companies might have rock-solid financials -- and pay a Treasury-beating dividend -- that doesn't mean their stocks won't fall. Apple is the case study in that. The company has a AA+ credit rating, just one notch below the perfect AAA, and a 2.2% dividend yield. That's a dividend the company can easily afford given its $215 billion in cash and investments. But just because a company has a high credit rating doesn't mean its stock can't fall. Stalling smartphone sales have crushed Apple's stock price by 11% this year and 30% from its high the past 52 weeks. Same goes with Wal-Mart (WMT). The retailer's nearly 3% dividend yield is attractive - but not without stock risk. Shares have lost about a quarter of their value from the high over the past 52 weeks.

What sell-off? 19 big stocks churn out gains

Its also important to note that dividends aren't like bond payments - they can be be cut or suspended or outright eliminated by companies at any time. And there's no guarantee that the credit ratings won't deteriorate. Exxon Mobil (XOM) is the other AAA-rated S&P company and yields 3.7%. But S&P put the company on a negative outlook - reminding investors that there's still risk. Shares closed Friday at $81.03, down 13% from their highest level over the past 52 weeks.

Returns from these stocks are far from guaranteed. And the underlying prices will certainly be riskier than that of Treasuries. But they're one of the more rock-solid things going and can give investors some added comfort in what is the stock market's most challenging stretch in years.