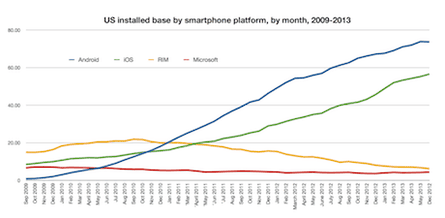

The total number of iPhone users will pass that for Android in the US next year, because those who join Apple's apps and services ecosystem tend to stay in its "black hole", according to a study by research firm Yankee Group.

By contrast, existing Android owners are more likely to switch away to other platforms - and in the US a significant proportion are considering, or have moved to, the iPhone. It reckons that that means the US has hit "peak Android", in which ownership of the Google-powered phones will remain at about 34% of the overall population.

The surprising prediction, in the face of rapidly growing Android shipments worldwide, saw some confirmation in data released by ComScore.

That showed that the total installed base of Android phones actually fell for the first time ever in June, by just 150,000 to 73.7m - while iPhone ownership continued an unbroken rise, increasing 1.3m in the month to 56.6m.

As the US smartphone market becomes increasingly saturated, with 59% of phone users already owning one according to ComScore, more people are replacing a smartphone purchased two or more years ago - and the data suggests that this is where Apple could reap benefits.

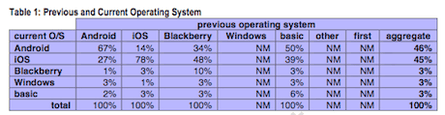

Data from Consumer Intelligence Research Partners (CIRP) surveying 500 people in the US who had bought phones between January and March found that iPhone owners were the most loyal: 78% who had one went on to buy another, while for Android the figure was 67%.

Yankee Group's data, which has been seen by the Guardian, suggests even higher loyalty: "only 9% of Apple owners plan to switch to another platform with their next phone purchase, while 24% of Android owners plan to defect from the platform," noted Carl Howe, its author, based on data collected from 16,000 people over the past 12 months in the US. It also says its data shows 18% of Android owners plan to buy iPhones subsequently, while 76% intended to remain with Android.

Samsung surprise

Surprisingly, Yankee Group said that Samsung owners were not particularly loyal: "despite the 24 different models of smartphones Samsung offered in the US market between 2010 and 2012, only 56% of Samsung smartphone owners intend to buy another Samsung smartphone," Howe noted. That is the highest within the Android ecosystem, above Motorola's 45%, HTC's 40%, and LG's 35%. (Android's overall loyalty rate is higher than that for any individual manufacturer because some Android owners switch between brands.)

"Most of Samsung's phone marketing budget today is spent on advertising and providing incentives to salespeople to push Samsung's phones," Howe commented. He suggests it should offer rebates, for loyalty, and "invest in providing more local service for broken and defective phones; many consumers who experienced 'sudden death' syndrome with their Galaxy S3s had to wait weeks to get replacements through their operators." He contrasted that with the availability of same-day replacement for faulty iPhones through Apple's own stores.

Ecosystems as leaky buckets

Yankee Group says that the battle of ecosystems between Android and Apple has now become key to people looking to renew their contract. "Once a consumer buys an iPhone, he or she is highly unlikely to switch to another ecosystem," it says, pointing to the loyalty figure. "Think of the Apple and Android ecosystems as two buckets of water. New smartphone buyers - mostly upgrading featurephone owners - fall like rain into the two big buckets about equally, with smaller numbers falling into Windows Phone and BlackBerry buckets.

"However, the Android bucket leaks badly, losing about one in five of all the owners put into it. The Apple bucket leaks only about 7% of its contents, so it retains more of the customers that fall into it. The Apple bucket will fill up faster and higher than the Android one, regardless of the fact that the Apple bucket hay have had fewer owners in it to begin with.

"With a limited supply of featurephone upgraders to draw from, the only way for Android to fill its bucket further is to leak fewer Android customers to other platforms." It recommends that Google find a way to "plug the loyalty leaks" by reinforcing the Android ecosystem brand, and crack down on manufacturers' varying implementations of the software: "Google can no longer afford its present laissez-faire attitude that allows hardware manufacturers to pick and choose Android features and deliver a sub-par experience that doesn't generate Android loyalty."

BlackBerry defections

Both CIRP and Yankee Group's data highlighted the problems faced by BlackBerry. Both found that it had the lowest loyalty among any of the smartphone platforms: CIRP said only 10% of existing owners who bought a new phone remained on the platform between January and March, its study of 500 phone buyers found.

Yankee Group's data, collected from 16,000 people over the past 12 months in the US, suggested even lower loyalty, finding the proportion of BlackBerry users intending to stay with it at around 5%.

That tallies with the ComScore data, which suggests that BlackBerry's consumer installed base in the US has declined from 7.6m in January to 6.2m in June. Separately, research company IDC reckoned that shipments of BlackBerry smartphones fell to just 5.1m, between April and June - lower than at any time since 2009.

The trend towards the iPhone in the US goes against broader global trends, where phones powered by Google's Android made up 80% of total smartphone shipments worldwide in the second quarter, while the iPhone comprised 13%. Viewed against the broader mobile market, Android-powered phones now make up 43% of the 432.1m mobile phones of all sorts shipped in the quarter, while Apple's iPhone - with 31.2m - was 7%, according to IDC.

The figures for Android include shipments of "AOSP" - Android Open Source Platform - phones in China, which are reckoned to make up at least a third of the total Android shipments on their own. However Android phones also make up a sizeable majority of smartphone shipments in Europe, Asia and other regions.

Feature attraction

In the US, Android does well in attracting buyers who own featurephones: the CIRP survey found that 50% of people who had a featurephone bought an Android phone, against 39% who got an iPhone. However both BlackBerry and Windows Phone fared badly in tempting featurephone users: only 3% of featurephone owners moved onto to either platform, against 6% who replaced their featurephone with another one.

Yankee Group's figures suggest a closer race between the two main OSs in attracting featurephone users: it found that 35% of them planned to go to Android, against 33% for Apple.

The figures offer little hope for Windows Phone or BlackBerry, however, which Yankee Group said could cull only 24% of upgraders. Of those, Windows Phone was significantly ahead, capturing 17% of intent against 7% for BlackBerry.

Tablet files

Yankee Group's study also suggests that similar loyalty dynamics apply in tablets, with 79% of iPhone owners who have a tablet owning an iPad, and 74% of those intending to get a tablet this year aiming for an iPad. Loyalty was less strong among Android phone owners, where only 50% intending to buy a tablet planned to get an Android one.

For Microsoft, 45% of Windows Phone owners also had a Windows-powered tablet, and 67% of the remainder who planned to get a tablet this year intended to get a Windows one. But with Windows Phone penetration low, the overall benefit to Microsoft is low, Yankee Group suggested.

Comments (…)

Sign in or create your Guardian account to join the discussion