Apple is leaning toward additional dividends or a share buyback program as part of its effort to return more cash to investors, according to sources. The US tech company could announce the move this spring, potentially in conjunction with a product announcement, the sources said.

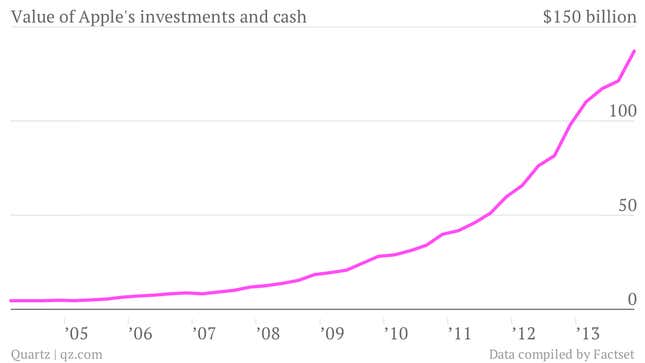

Apple has been under pressure from hedge fund manager David Einhorn of Greenlight Capital to return some of its more than $137 billion in cash to investors. Einhorn has called for Apple to pay out perpetual dividends through a mechanism he’s dubbed as “iPrefs.” Apple has hired Goldman Sachs to help it assess its options, especially in light of Einhorn’s moves, the sources said.

Apple’s zeroing in on a dividend or buyback was in the works before Einhorn made his complaints public in February, although some of the sources say Apple increased the size of its plan after Einhorn’s comments. And although Apple CEO Tim Cook publicly called Einhorn’s lawsuit a “silly sideshow,” the company found his idea of preferred shares “interesting,” sources said. If it decides against a share buyback, Apple could either raise its existing dividend, which the company started paying this year, or issue a special dividend.

Apple has said it is in active discussions about returning cash to investors. And Cook has said that Apple officials are conscious of the company’s lagging stock price. Last year, Apple announced plans to return $45 billion in cash over three years. Its new plan to return more cash would come on top of that, the sources said. It’s unclear how much cash Apple will return but the company has the capacity to give another $45 billion or more to investors.

Apple has considered using its cash to buy other companies but Cook has said he hasn’t found any big targets that passed muster, leaving the company with the largest cash pile of any US company.

Apple shares have fallen by almost 40% since September, when they were above $700 a share. In the same time, Google’s stock has gone up by more than 17% and is now trading around $834 a share. Google has replaced Apple as the stock most owned by the 50-largest actively managed mutual funds in the US. At the same time, Apple is facing increasing competition in the mobile and tablet markets from Samsung and other device makers using Google’s Android operating system software.

The announcement of the new cash distribution could possibly come alongside Apple’s unveiling of upgrades to the iPhone and/or iPad mini, which are rumored to be in the works. When announced, it is likely to give Apple’s shares a boost.

Whoever gets credit for Apple’s plan to return more cash, the move shows Apple is no longer immune to shareholder pressure. The company now walks among the mortals.