On Tuesday, February 12, Apple CEO Tim Cook spoke at the Goldman Sachs Conference and provided us all with some miscellaneous thoughts on the state of Apple. What follows are my thoughts on his thoughts. (All quotes are from Tim Cook unless otherwise attributed.)

On Tuesday, February 12, Apple CEO Tim Cook spoke at the Goldman Sachs Conference and provided us all with some miscellaneous thoughts on the state of Apple. What follows are my thoughts on his thoughts. (All quotes are from Tim Cook unless otherwise attributed.)

Cannibalization

“The cannibalization question raises its head a lot. The truth is, we really don’t think about it that much. Our basic belief is, if we don’t cannibalize, someone else will. In the case of iPad particularly, I would argue that the Windows PC market is huge and there’s a lot more there to cannibalize then there is of Mac, or of iPad. I think if a company ever begins to use cannibalization as a primary or even a major factor of what products to go to, it’s the beginning of the end.”

Some variation of this statement should be tacked on the wall of every corporate CEO in the world. We live in an age of accelerating disruption. If you don’t constantly seek to disrupt (cannibalize) yourself, someone else will surely do it for you.

Low-Cost Phone

“We are making moves to make things more affordable. When we came out with iPod it was $399, today you can buy an iPod Shuffle for $49. Instead of saying how can we cheapen this iPod to get it lower, we said how can we do a great product, and we were able to do that. The same thing, but in a different concept in some ways.”

Industry watchers should pay particular attention to these words. Notice that Cook didn’t say that the price of the iPod had dropped. Rather, Apple created a wholly new product in the form of the Shuffle that provided a lower cost alternative to the iPod

During the holiday quarter, Apple sold almost every iPhone 5 that they could make. Apple is not going to make a lower cost phone just to make a lower cost phone. Like the Nano and the Shuffle, Apple will make a lower cost product if they can find a way to provide greater value to their customers. But like the Nano and the Shuffle, it’s likely to be a wholly new product, not just a cheaper version of the original.

Apple Retail Stores

“The average store last year was over $50 million in revenue.”

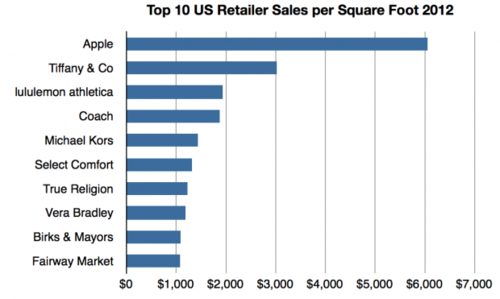

As the chart from Asymco, below, shows, Apple didn’t just make double the per square foot value of the average retail store, they made double the per square foot value of the second best retail store in the world (Tiffany). To say that this is astonishing is to damn with faint praise.

An average of fifty million in revenue, per store. That’s breath taking. There isn’t a CEO in the world who wouldn’t give their eye teeth to have such numbers.

Demand

“We had a difficult time last quarter with satisfying everyone.”

On January 13, 2013, The Wall Street Journal reported:

“Apple Inc. has cut its component orders for the iPhone 5 because of weaker-than-expected demand, people familiar with the situation said…” ~ Wall Street Journal

Well, “people familiar with the situation” should be embarrassed and the Wall Street Journal should be mortified for printing that poppycock. We now know that Apple couldn’t make iPhone 4, iPhone 5, iPad Mini and iMacs fast enough. Apple’s inability to meet demand may be a problem, but demand most assuredly was not their problem last quarter.

Tablets

“The tablet market will be huge, it will be a huge opportunity for Apple.”

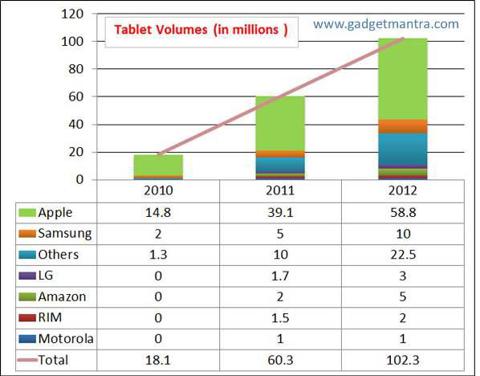

“If you look at the full year last year, there were more iPads sold than HP sold of its entire PC line-up. There has been a sea-change. We’re in the early innings of this game. The projection is that this is going to triple in 4 years. When you think about that, the actual number is 375 million, that’s more PCs than are being sold around the world. The tablet is attracting people who have never owned a PC and people who have owned them but aren’t great in the experience.”

“Sea change” is exactly the right phrase to describe what is happening in computing. The inimitable Horace Dediu commented that: “…iPad revenues were $10.6 billion last quarter. Google revenues (ex-Motorola) were $12 billion and Microsoft’s Windows and Windows Live were $5.9 billion. It won’t be long before iPad will be bigger than both Windows and Google.

Below is a chart showing the relative position of Apple to other tablet manufacturers.

(Image courtesy of Why Apple Will Continue To Climb)

To put it in a nutshell, no one is better positioned to take advantage of the changeover from notebooks and desktops to tablets than Apple is.

So, to sum up, iPhone revenues already exceed all those of Microsoft and the iPad is about to duplicate that feat. That’s a pretty nice little business you’ve slapped together there, Mr. Cook.

Market Share

“I have no idea what market share is, we’re the only company that really reports the units we sell.”

Does Apple’s market share really matter all that much? Well, let me put it this way. During the past year and a half, Android’s market share numbers have exploded. And what is the price that Apple has had to pay? Apple has INCREASED its profit share from 50% in May 2011 to 72% last quarter. And they’ve done all that while only controlling a total of 7.8% of the mobile handset sales. There isn’t a business in the world that wouldn’t gladly take profit share over market share. And that should be the end of the story.

Of course, the counter-argument is that profits are a trailing indicator and that dominant market share must, inevitably, lead to a dominant platform. Only all the available evidence says just the opposite. Apple has the smaller market share, but they have the dominant platform. In fact, Tim Cook just provided us with 8 billion more pieces of proof to support that claim.

“…we built an ecosystem that is the best in customer experience on the planet. In addition, it’s fueling an incredible economic gain for developers. We’ve paid over $8 billion to developers.”

For those of you who are keeping score at home, that’s a jump of $1 billion in payments to developers in just one month.

Here’s a rule for us all to live by: When our theory conflicts with reality, we should create an alternative theory, not an alternative reality.

(As an aside, if Apple has 72% of the mobile phone profit share with only 7.8% of the market share, then with about 50% market share in tablets, what do you suppose their profit share is?)

Apple’s Achilles Heel

“If you look at skills, Apple is in a unique and unrivaled position. Apple has skills in software, in hardware, and in services. The model of the PC industry, that model’s not working for what consumers want today. Consumers want an elegant experience where the technology flows to the background. The real magic happens at the intersection of these, and Apple has the ability on all three of these spheres to innovate like crazy and really cause magic.”

One of the keys to the Macintosh was its hardware and software integration. One of the keys to the iPod was its integration with iTunes. One of the keys to the iPhone and the iPad was their integration with the App store.

Tim Cook correctly identifies one of the keys to Apple’s future – the integration of hardware, software and services. And he’s right when he suggests that the model of the PC industry is not working for what consumers want today. This is evidenced by the fact that many companies are moving toward a more integrated approach.

However, while Cook states Apple’s integration as a fait accompli, it is, at best, a work in progress. Apple has proven its competency in integrating hardware and software but with services like iCloud, maps, game center, etc., the jury is still out.

It is good that Tim Cook is talking about the integration of hardware, software and services. But whether Apple can deliver on the promise of his words is still an open question. And the future success of the company may well rest on the answer that Apple – and its newly revamped administrative team – provides over the next two years.

There are two companies that have been phenomenally successful: Apple and Amazon. Both of them have the customer experience as their first priority and I’m convinced that their success is a direct result of that. I would like to ask the CEOs of some other businesses why they put investor satisfaction or beating their competition ahead of everything else. To me those ambitions are driven by what (if I wanted to be polite) I would call misplaced priorities.

Apple made more profit in the final quarter of 2013 than Amazon has made during its entire existence since 1995. So what do you mean by “successful?” Amazon is barely profitable. They are almost a charitable organization.

As far as devices, Kindle does not even outsell iPod. More people read books on iPad than Kindle, and Kindle is years older.

When I say Amazon is successful I mean that they now sell what seems like every product in existence, that they’re the largest online merchandiser, and that they’ve become big enough to worry Walmart, and are still growing rapidly in terms of number of items sold per year. I’ve read that brick and mortar stores view Amazon as a serious threat to their business and is becoming a greater threat every year. Ask them if they think Amazon is successful. It wouldn’t be happening if Amazon didn’t satisfy their customers.

I know many people criticize Amazon for having very low profit margins. I would answer that with a sports analogy…if a football team wins every game they play by just 2-3 points and does this year after year, then despite the small margins they’re still beating the other teams.

Since Amazon is selling everything under the sun and has a world wide reach and yet they are making pittance in profits. Their revenue may grow by leaps and bounds but their net profits don’t measure up.

Their next worry should be sales tax and completed well with B&M because their customers don’t pay sales tax.

Beside their revenue grows because they buy companies to add on to it.

I may be wrong their days ahead may not be as rosy as you had mentioned.

As I understand it, Amazon does not make much stated profits, because over their history, they have aggressively plowed profits back into growth. Remember, Amazon started as a book seller. Then they added CDs and videos. Then they added this, that, something else, and so on until they became the behemoth they are today. The point is, they keep adding to their product line and infrastructure, to enable further growth.

They are growing revenue strongly, investing pretty heavily in infrastructure and services to keep operating costs low, expanding country reach and are being successful in squeezing out their B&M opposition. The book shops are almost gone, the record/video stores are gone (thanks Apple too), and the big box and specialist electronics shops are struggling. I would think that these are a high proportion of volume and value on the retail side.

For many of the rest of the categories, they can offer good deals but can also be wildly uncompetitive (and many marketplace vendors are usurious) but I doubt that those areas provide much revenue or profit. Amazon may feel a bit haphazard but I think they have a very clear idea of where they are going (nowhere near Apple). To compare the 2 is false logic. If it weren’t for the insanity of the relative stock prices, P/E ratios and reaction to results, people would not be so critical of the company. We don’t berate Apple for the idiocy of the markets, nor should we, Amazon.

Personally, my new year’s resolution was to buy less from Amazon and more from local B&M sellers. It’s not going too well since they opened an Amazon locker 1 block from my house.

Apple has been at the center of personal computing the whole time. They started the PC industry in 1977. It is no surprise at all that they are still at the center of it. The only surprise may be that Apple now makes its own mass market versions of its products, obsoleting Microsoft’s role. In other words, today’s half-price Mac is not a Windows PC anymore but rather an iPad.

Maybe I missed this comment in your post regarding Tim Cook:

“Speaking this morning at the Goldman Sachs Technology and Internet Conference, he called the tablet market “the mother of all markets”

Doesn’t anyone understand what this means. The tablet, not the phone, not the TV, certainly not PCs or the watch is the mother of all markets. It means that the successor of the PC is the tablet and no one else is in position to replace it except Apple. The rest of the offerings in the mobile industry is just noise. The tablet is the key to the leadership role of computing in the future. This is because of apps. It has been apps (previously called applications) when IBM was dominant, when Microsoft is/was dominant and it will be the measure of success of any future dominator (sorry Arnold). Apps are the measure of dominance and in the tablet market, IMHO, will belong to Apple in the future.

Just don’t get me started. 🙂

“The tablet, not the phone, not the TV, certainly not PCs or the watch is the mother of all markets.” – Gwisher

Agreed. That’s why I said: “To put it in a nutshell, no one is better positioned to take advantage of the changeover from notebooks and desktops to tablets than Apple is.”

I rarely have any comment that would add or detract from your wonderful articles. What you say is part of what I said. The addition I would make to that statement is that the tablet market is the key market. Everyone is focused on phones or some new product that Apple may or not introduce in the future. While all these components are important, they are not as important as the tablet IMHO. 🙂

“… the tablet market is the key market…” – Grwisher

I agree. I’ve been arguing that since about mid 2011. The smart phone is fantastic and can’t be discounted. But the tablet is the second coming of the computer revolution. It’s not only going to replace notebooks and desktops for the average user, it’s going to bring an entire new class of users into computing.

I do not even understand how I ended up here, but I assumed this publish used to be great

I do not even understand how I ended up here but I assumed this publish used to be great