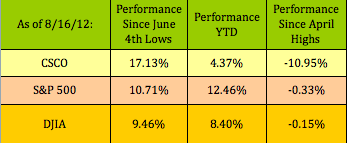

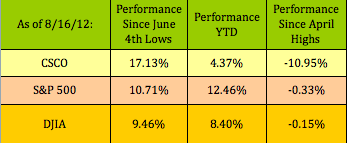

After getting bashed in the 2nd quarter, Cisco Systems, (CSCO), stock has done well this summer, gaining over 17% since the June lows. CSCO is also one of the top 4 Dow 30 performers over the past trading month, gaining 6.90%, and trailing only Home Depot (HD), Caterpillar (CAT), and IBM (IBM), which leads the Dow pack with an 8.49% gain.

Even with its big summer gains, CSCO still trails the market year to date:

Thanks to a stronger fiscal 4th quarter earnings report, in which adjusted EPS rose 18% vs. fiscal Q4 2011, Cisco’s full year 2012 EPS growth also looked good. In fact, one could argue that CSCO is still undervalued on a 2012 PEG basis. Looking forward, the consensus for 2013 calls for 10.81% EPS growth, which puts CSCO a bit over the 1.00 PEG threshold for being undervalued.

However, using the consensus future earnings growth rate of 8.09%, with a risk-adjusted 10.41% discount rate, shows CSCO’s estimated value to be approximately $23.25, indicating that CSCO is currently undervalued by well over 20%.

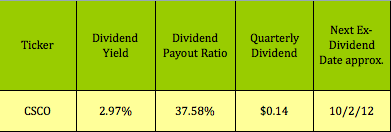

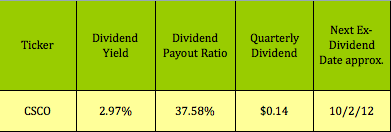

Dividends: After having joined the universe of dividend stocks in 2011, CSCO is now approaching the arena of Tech high dividend stocks. CSCO just ratcheted up its quarterly dividends big time, by announcing a huge 75% increase, going to $.14, from $.08. This is the second increase in 2012 – CSCO increased its dividend in the 1st quarter to $.08, from its initial $.06 payout. This new higher dividend payout ups CSCO’s dividend yield significantly, to just below 3.00%, which is in the higher range for most Tech stocks:

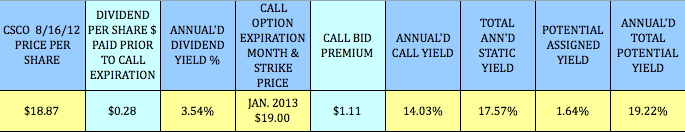

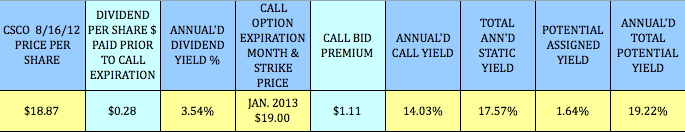

Options Outlook: If you’re interested in pumping up CSCO’s dividend yield even further, you can gain additional immediate income via selling covered calls. Since the $19.00 call strike price is only $.13 above CSCO’s mid-day $18.87 price, it appears that you would risk having your CSCO shares assigned/sold before you collect one or both of the $.14 quarterly dividends before the Jan. 2013 expiration.

However, your Assigned compensation would be much more than the dividends anyway: $1.11 in call premium now, plus $.13 in assigned price gain, for a net gain of $1.24, a 6.57% gain. If your shares were assigned near the October ex-dividend date, in under 2 months, this would equal a 39%-plus annualized yield approximately. Conversely, if your shares are never assigned, the minimum yield you’d make would be a 17.57% annualized static yield.

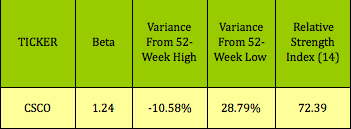

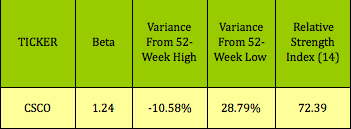

Here’s a look at where CSCO is at price-wise over the past 52 weeks. With a very strong relative strength of 72.39, you certainly can’t say that CSCO is oversold:

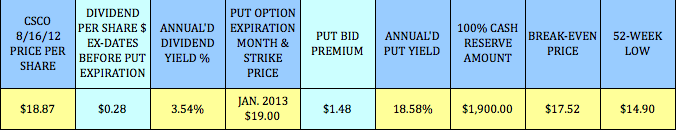

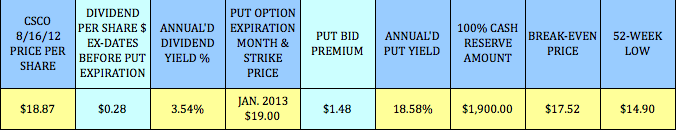

Cash Secured Puts: Given CSCO’s recent big rise, a cautious way to still profit would be to sell cash secured put options. This January 2013 put gives you a break-even price of $17.52, in addition to offering an annualized yield of over 18%, over 5 times the dividend amount.

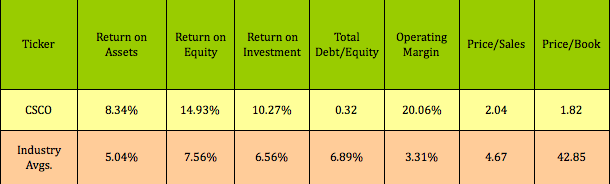

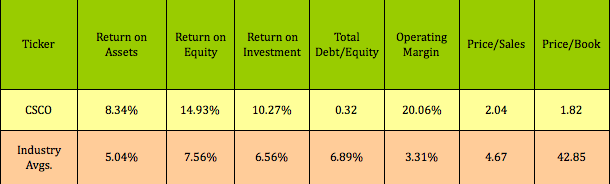

Financials: As Cisco is such a dominant player in its industry, industry comps are a bit dicey. However, these comps do include other large firms that compete with Cisco in certain areas, such as Juniper, (JNPR), Alcatel-Lucent, (ALU), and Hewlett Packard, (HPQ):

Disclosure: Author was long CSCO shares and short CSCO puts at the time of this writing.

Disclaimer: This article is written for informational purposes only and isn’t intended as investment advice.

Even with its big summer gains, CSCO still trails the market year to date:

Thanks to a stronger fiscal 4th quarter earnings report, in which adjusted EPS rose 18% vs. fiscal Q4 2011, Cisco’s full year 2012 EPS growth also looked good. In fact, one could argue that CSCO is still undervalued on a 2012 PEG basis. Looking forward, the consensus for 2013 calls for 10.81% EPS growth, which puts CSCO a bit over the 1.00 PEG threshold for being undervalued.

However, using the consensus future earnings growth rate of 8.09%, with a risk-adjusted 10.41% discount rate, shows CSCO’s estimated value to be approximately $23.25, indicating that CSCO is currently undervalued by well over 20%.

Dividends: After having joined the universe of dividend stocks in 2011, CSCO is now approaching the arena of Tech high dividend stocks. CSCO just ratcheted up its quarterly dividends big time, by announcing a huge 75% increase, going to $.14, from $.08. This is the second increase in 2012 – CSCO increased its dividend in the 1st quarter to $.08, from its initial $.06 payout. This new higher dividend payout ups CSCO’s dividend yield significantly, to just below 3.00%, which is in the higher range for most Tech stocks:

Options Outlook: If you’re interested in pumping up CSCO’s dividend yield even further, you can gain additional immediate income via selling covered calls. Since the $19.00 call strike price is only $.13 above CSCO’s mid-day $18.87 price, it appears that you would risk having your CSCO shares assigned/sold before you collect one or both of the $.14 quarterly dividends before the Jan. 2013 expiration.

However, your Assigned compensation would be much more than the dividends anyway: $1.11 in call premium now, plus $.13 in assigned price gain, for a net gain of $1.24, a 6.57% gain. If your shares were assigned near the October ex-dividend date, in under 2 months, this would equal a 39%-plus annualized yield approximately. Conversely, if your shares are never assigned, the minimum yield you’d make would be a 17.57% annualized static yield.

Here’s a look at where CSCO is at price-wise over the past 52 weeks. With a very strong relative strength of 72.39, you certainly can’t say that CSCO is oversold:

Cash Secured Puts: Given CSCO’s recent big rise, a cautious way to still profit would be to sell cash secured put options. This January 2013 put gives you a break-even price of $17.52, in addition to offering an annualized yield of over 18%, over 5 times the dividend amount.

Financials: As Cisco is such a dominant player in its industry, industry comps are a bit dicey. However, these comps do include other large firms that compete with Cisco in certain areas, such as Juniper, (JNPR), Alcatel-Lucent, (ALU), and Hewlett Packard, (HPQ):

Disclosure: Author was long CSCO shares and short CSCO puts at the time of this writing.

Disclaimer: This article is written for informational purposes only and isn’t intended as investment advice.