Gartner is the latest of the big analyst houses to release its numbers for smartphone and overall mobile sales in Q2. The picture it paints is one of a market that has, effectively, one winner at the moment: Android — and more specifically Samsung — with growth for Apple’s iPhone “paused” as users hold out for the next iPhone and ride out the tough economy.

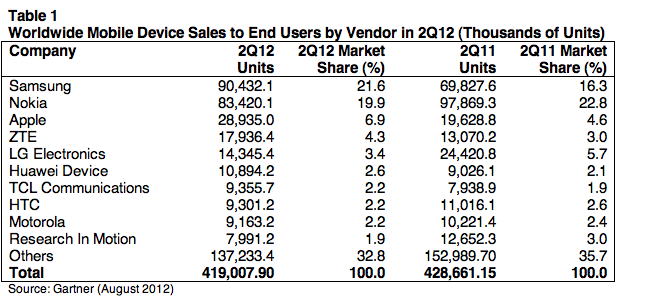

Worldwide, there were 419 million phones sold to end users, is down 2.3% compared to a year ago, Gartner says. Just over one-third (36.7%) of all devices sold were smartphones, which continued to grow well even as the wider market (which includes feature phones) declined. Sales of smartphones were up by 42.7% to 154 million units, with Apple and Samsung together accounting for 83% of all smartphone sales.

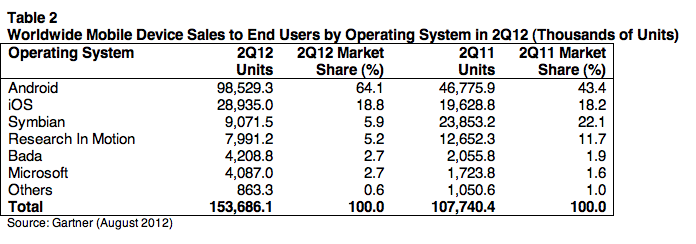

Within the smartphone category, Android, led by Samsung, is reaping the most benefits from that growth at the moment. With nearly 99 million units sold, Android devices captured 64% of the smartphone market for the quarter (compared to 43.4% a year ago). Samsung’s Galaxy line of devices accounted for more than half of all Android sales, reaching 45.6 million devices sold.

And as a testament to the power of a good, new product launch, the new S3 sold 10 million units in its first two months of its release. “The Galaxy S3 was the best-selling Android product in the quarter and could have been higher but for product shortages,” Gartner notes.

Apple’s iOS-based iPhone devices, meanwhile, also saw growth, selling nearly 29 million units, but this was only in line with overall smartphone market expansion, so its share remained largely the same: it captured 18.8% of the smartphone market (versus 18.2% the year before). Gartner notes that sales of the iPhone fell by 12.6% compared to Q1.

Both Symbian and RIM saw big drops and are both hovering between 5% and 6% market share for sales last quarter, while Samsung’s bada and Microsoft saw modest, single-percentage gains to be level at 2.7% shares (equivalent to around 4 million devices).

Incidentally, do you remember when Nokia said it sold 4 million Lumia devices in Q2? That paints a particularly bad picture for how well the other OEMs are doing with WP7: between the rest of them they sold only about 87,000 devices, according to Gartner’s numbers. Ouch.

Apple’s Tim Cook told us in its Q2 earnings last month that the company was seeing lower iPhone sales in the quarter because of economic presssures, particularly in Europe, as well as a general lag due to people waiting for the new iPhone to hit the market (which by many reports it will do come September). Gartner essentially agrees with this assessment:

“The challenging economic environment and users postponing upgrades to take advantage of high-profile device launches and promotions available later in the year slowed demand across markets,” wrote Anshul Gupta, principal research analyst at Gartner, in a statement.

But he added that there is a converse to this, too, if the iPhone does in fact launch: “The anticipated Apple iPhone 5, along with Chinese manufacturers pushing 3G and preparing for major device launches in the second half of 2012, will drive the smartphone market upward,” he noted.

That growth, he says, will be primarily in smartphones. Lower-end devices will “continue to see pressure”, even if they continue to sell well in emerging markets.

Indeed, at the moment, it is feature phones that seem to be keeping Nokia alive in terms of phone sales (yes, the platform is burning, but it’s still standing up). While Nokia saw big declines in its smartphone stature — Symbian market share dropped by nearly 17 percentage points, and Windows Phone 7 saw only modest gains — the impact of that was only saw a small decline in overall world rankings, where Nokia now stands at just under 20% market share compared to 23% a year ago. It has feature phones to thank for that.

The picture is different for the world leader: buoyed by its strong sales in smartphones (over half of all devices sold by Samsung) and feature phones, Samsung is playing the game perfectly. It improved its market by nearly five percentage points to 21.6% marketshare, working out to over 90 million units sold. The distance between Samsung/Nokia and the rest of the pack is big at the moment. Apple comes in third but a ways behind with 29 million units. That shows how challenging the mobile market, which needs to operate at scale to be profitable, is at the moment for the majority of the industry.

Google’s Motorola is among the challenged ones. Yesterday the company set out a long-term plan to move away from feature phones to smartphones; it will be worth watching to see how that impacts the company’s standing in the wider rankings — perhaps very little since Motorla has been relying less on feature phone sales than companies like Nokia and Samsung. It took 2.2 percent share of sales in Q2, down 0.2 percentage points from last year.