Betting on America: How Much Do Apple and Google Invest at Home?

One of the more frustrating aspects of the thriving U.S. tech sector is that while its leading companies generate fabulous profits, they don't actually employ that many American workers -- especially compared to industrial titans of yore. At its 1970s peak, General Motors had more than 600,000 U.S. workers on its payroll. Apple, by comparison, claims just 47,000, most of whom are part of its retail operations. Google has about 18,500. They've perfected the low-employment, high-profit business model.

But measuring a tech company's economic impact by its headcount alone is more than a bit misleading, in part for reasons I've written about previously. Michael Mandel of the Progressive Policy Institute, an occasional Atlantic contributor, has done some of the most interesting work on the topic, showing how California's tech behemoths indirectly support hundreds of thousands of workers who produce and market mobile apps.

The relationship between job creation and business investment isn't necessarily straightforward. Take manufacturers who automate their production lines through robotics. They're investing in machinery, sure, but probably cutting assembly workers, too. The tech industry analysts at Forrester argue that many companies have chosen to upgrade their IT rather than hire more employees in recent years.

But those caveats aside, domestic investment is overwhelmingly good for the economy. It generates more overall business activity. It makes our companies more productive and competitive, which leads to growth over the long term, and it anchors them here in the U.S., especially when they build physical spaces. Much of Apple's $2 billion in capital spending was dedicated to its second California campus, and as the PPI report notes, the company has stated in filings that it plans to spend another $8 billion here in the coming year. That means jobs for workmen, and all the other economic cascade effects that come with big construction projects.

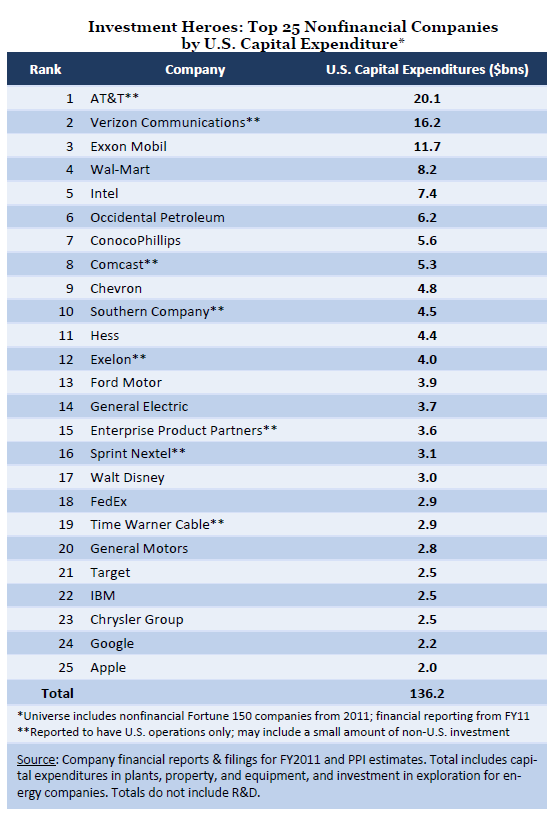

Notice though: companies with far smaller market values than Google and Apple are still investing much more here at home. Walmart and Exxon Mobil, which are both dwarfed by Apple's market cap, invested $8.2 billion and $11.7, respectively. AT&T spent a whopping $20 billion. What that demonstrates is how compared to the other healthy sectors of the U.S. economy dominated by mega-corporations -- telecommunications, energy, retail, and autos (yes, autos), tech is still a fairly low-overhead industry. Talent isn't cheap, but you don't need much of it, and you certainly don't need the sort of expansive, expensive infrastructure of a big-box chain or a wireless provider.

In short, Apple, Google and their tech industry competitors are bound to pump some of their enormous profits back into the economy. That leads to growth and jobs. They just don't have to pump in as much as some of their corporate peers.