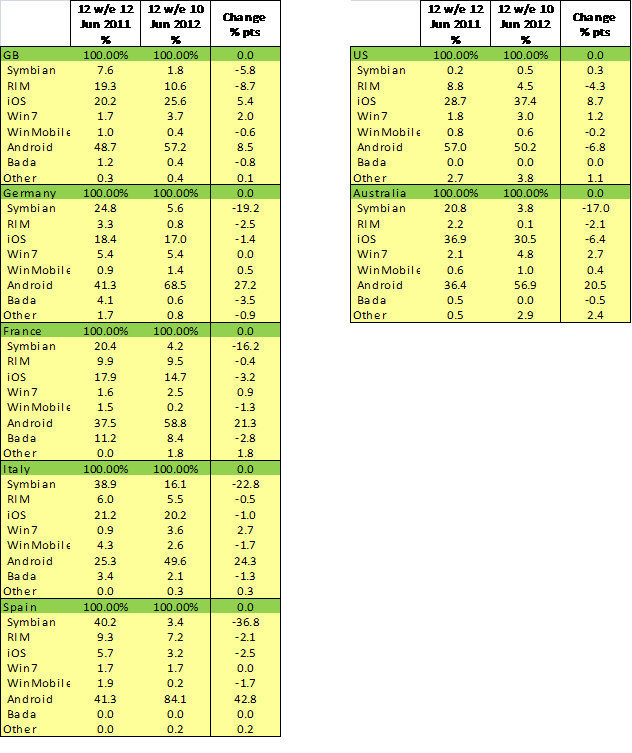

Kantar Worldpanel ComTech, a market analysis division of WPP, has today published its latest figures on mobile device sales across a number of key markets, and it looks like something of a milestone for Android: this is the first time in ComTech’s recording of sales that Android has accounted for more than half of all smartphone sales in the U.S., the biggest markets in Europe, and Australia.

The sales, recorded over the last 12 weeks that ended June 10, put Android sales in a range going from 49.6 percent of all smartphone sales in Italy to 84.1 percent of all smartphone sales in Spain.

These numbers are a crucial barometer of how well Android devices are selling in the market: Google typically talks activations but not actual sales of handsets. Andy Rubin in June noted that Android device activations are now numbering at over 900,000 per day.

They also underscore the competitive threat the Google represents to all other platform operators at the moment. The newer entrant, Microsoft’s Windows Phone is showing positive signs, in that its percentage of sales is growing in different markets, but it remains in the single digits, and will be hard-pressed to make inroads in the short term with Android device makers continuing to perform so well.

Dominic Sunnebo, consumer insights director at Kantar Worldpanel, puts the popularity of Android down to a crucial factor: a lot of people are migrating from feature phones and Android represents just the right nexus (sorry!) between price and functionality.

Kantar Worldpanel’s research shows that Android devices are particularly successful with people who spend $50 and under for devices (typically sold with subsidies from carriers when you buy the device under contract), in the “vast majority” of countries covered in its research. “Android handsets currently offer an easier platform to enable these consumers to upgrade, as many first time smartphone consumers state ‘price of handset’ and ‘multimedia capabilities’ as their main reason for choosing an Android device,” he writes in the news release.

But what’s really the killer with Android is that it’s also becoming the migration platform of choice for smartphone owners, too. For example, in the UK, Worldpanel notes that the Samsung Galaxy Ace and Y are popular choices for young people who were previously using — “traditionally loyal” in its words — to RIM’s Blackberry. (Fun fact: the 20 year-old au pair who lives in my house is precisely the young user Worldpanel’s talking about. She’d had a BlackBerry; now she uses a Galaxy Ace.)

But what about the iPhone, you ask? Well, iOS smartphones are still doing fine, and in markets like the U.S. they are actually still gaining at the expense of Android. Google’s OS is still the biggest there, at 50.2 percent, but that’s actually a decline of 6.8 percent compared to the same 12-week period last year. iOS’s share, meanwhile has grown by 8.7 percentage points to 37.4 percent of all sales in the market, fueled partly by wider availability on Sprint’s network. iOS was, in fact, the only platform whose sales grew over the period in the U.S.

Another point worth noting is that Kantar Worldpanel’s figures also provide a rather stark picture of who is on the way down — the counterbalance to who is going up. RIM and Symbian saw declines in sales shares in just about every market listed below: the one exception is Symbian in the U.S., where the share of sales is so small — just 0.5 percent — but at least a rise of 0.3 percentage points compared to the same period a year ago.