SAP and Oracle up the ante in the phony database wars

Doug Henschen had a fun piece on Information Week about the latest round in the war of words bubbling up over SAP HANA v Oracle Exalytics. I'm not going to dive into the technical 'he said/she said' stuff because a) I don't claim to fully understand it and b) it's irrelevant for the purposes of my argument.

Here's what I think is going on.

When SAP trumpeted the claim that it would be the number two database player by 2015, it forgot to do some fundamental math. At least according to my reckoning. In a conversation with Steve Lucas, SAP database executive, we batted numbers back and forth. While we didn't exactly agree, he didn't exactly disagree with what I was saying. At the time I wrote:

Right now and depending on whose numbers you want to read, SAP would have to grow its overall HANA and Sybase database business something around six to seven times from the existing numbers over the next few years. That assumes a static market whereas the indications are that database demand will grow rapidly. SAP can benefit from that growth organically but then so will everyone else. In the meantime, it has major obstacles to overcome.

SAP makes much of the fact that HANA accounted for €160 million (or US $210 million) in net new sales last year but then I see that Oracle grew its DB licenses by $141 million in the last reported quarter. (p8 - PDF download) You can be certain that Oracle will make Q3 sales seem paltry when it closes out the fiscal year next month. By any measure, SAP has a mountain to climb when compared to the number one database company. Add in the fact Larry Ellison, CEO Oracle will relish in ribbing SAP for sipping its own brand of milkshake and you have a heady mix of FUD, counter-FUD and plain silliness ahead.

You can read this anyway you wish but two things should be obvious:

- Making such an outrageous claim without explaining the 'how' of getting from A to B was a PR gift to a company like Oracle.

- Oracle's push back looks like SAP just stuck a big fat target on its back and said: 'Kick Me!' And just as surely, that's what Oracle has done according to Henschen.

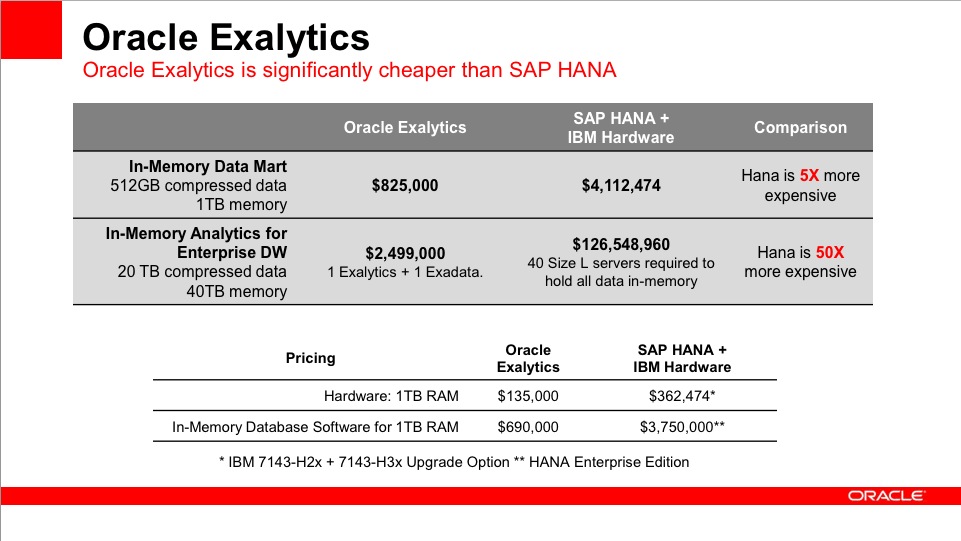

Now, we have SAP calling foul on Oracle's Thomas Kurian for his bending of the facts in providing an equally mind boggling cost comparison. (see image at top of post.)

I am reasonably close to some aspects of HANA and this is what I know.

Hardware costs are plummeting and technology that goes into HANA boxes is progressing at one heck of a lick. The other week, I saw a box one colleague calls 'FrankenHANA' which not only sounds like a 747 in take off mode but which is way faster than anything else seen to date at the specification. It also comes in at a price point that would have been unthinkable even a year ago. I'm not allowed to say what that price is because the machine is still under final tweaking. Let's just say that if what I'm told is correct then Kurian is way out of touch on current available hardware pricing. Orders of magnitude out of touch.

That doesn't matter to Oracle because for as long as it is shipping its engineered systems i.e. Exalytics, the Enterprise X-box plus services only it can realistically deliver, the company is coining it all the way to the bank. That's the sort of music Oracle and its Wall Street masters like to hear. Add in the fact Oracle has control over all the moving parts and you start to see some interesting price negotiations looming if price becomes a competitive issue.

Since the initial trumpeting of the no. 2 slot assertion, SAP has back peddled, saying that it wants to be the fastest growing database company. That's more credible given it is coming off a tiny installed base but Oracle won't let SAP off that lightly as is evident from the latest exchanges. Or if it does, then it will be dripping with the kind of sarcasm only Oracle is able to deliver and still leave some commenters giggling.

However, and this is where it gets really interesting, HANA is not about the database at all. The database merely serves as one part of a much more sophisticated model that SAP is developing. It centres around the new kinds of application that would not be possible without HANA. HANA is therefore much more than a technical database, it is an entire stack designed to do two (basic) things:

- Chop out layers of complexity in enterprise application landscapes

- Serve as the foundation for any number of applications that developers can dream up.

When viewed in this way, SAP represents a far more potent threat to both Oracle and IBM than when seen only through the eyes of the database argument, albeit the database element must be of genuine concern to its competitors.

While SAP today talks up analytics, this itself is only a temporary staging post, a jumping off point if you like for the creation of new styles of application. Henschel's article talks about a clutch of examples but with one huge caveat (my emphasis added):

SAP recently offered a handful of customer examples, including Centrica (mentioned above), Aqualectra (another utility), Medidata (a SaaS-based service firm that helps big pharmaceutical companies run clinical trials), and an unnamed Japanese retailer. But the summary stories were loaded with platitudes like, "Hana helps us bring our customers new efficiencies that they never even dreamed of." Okay, like what? If I'm spending big bucks, I want rich details about tangible competitive advantage.

SAP has a genuine problem (or three) here. On the one hand customers can see the advantages of speed but then what? In my discussions with Camelot, the UK's lottery operator, their challenge is that the power HANA puts into their hands creates a situation where business analysts may be overwhelmed with potential scenarios. They need coaching in figuring out which use cases provide the biggest bang for the buck. They will not be alone.

SAP has made a few mistakes in its go to market with HANA that mean they don't have the hundreds of use case examples that would cement the argument in its favor.

During the early part of the first year of going into general availability SIs and developers had a difficult time getting adequate resources with which to build their own HANA applications, documentation and answers to bug queries. SAP's partners justifiably complain that they don't yet see an SDK against which they can build, so are limited in what they can offer customers.

Similarly, SAP has effectively been subsidising HANA sales through discounted consultancy that only it can deliver, dealing another blow to the partner ecosystem.

Keeping partners at bay in the early stages makes sense when you believe that you can max out the revenues for a new product. The flipside is that the application demand created by HANA quickly becomes such that SAP alone cannot develop all the solutions the market wants. I can only find 20 published use cases. It is hardly surprising then that Vinnie Mirchandani chides SAP:

Last week in a call with SAP I told them that years after talking about HANA I would have expected it to have at least 20,000 customers with some level of adoption.

SAP needs the IBMs, Accentures, Deloittes, CapGeminis along with a host of mid-range SIs to bulk up on the number of available market solutions that in turn drives market adoption. It needs the developer stories to supplement its own efforts.

Despite these concerns, I recently had a glimpse of some promising work undertaken by IBM that talks directly to a working capital finance use case I term as 'self evident.' (see video above.) By that I mean that what it does is obvious to a finance person as is the value that could be derived. I can see plenty of revenue for SAP/IBM tied to huge value derived from better cash management.

To its credit, SAP knows the problems and is trying to figure out how best to balance its own revenue needs against those of the broader SAP customer community. The $155 million fund for third party HANA apps is a good start. Hopefully, there will be more good news at the upcoming SAPPHIRE in a couple of week's time. My fear is that they will once again fall into the trap of announcing things that are either too early in the development cycle or are too difficult for customers to understand.

There is another problem that should not be under-estimated. The SAP developer ecosystem is not used to what are emerging as the 'new rules' of developer led sales. The days when you could rely on a seemingly endless stream of large scale projects and custom development are largely over.

HANA may yet provide fresh customising opportunities but the emphasis is on solutions that have broader appeal. That doesn't obviate the need for customisations in many current landscapes but it does create a different type of market. It is one where the developers not only have to be attuned to customer problem solving but have to actively market what they build to many more customers than in the past. From what I have seen, very few SAP developer shops understand this dynamic.

In the meantime and as I have said before, Oracle will continue to crank out webinars, 'fact sheets,' the odd talking head lathered with its own brand of competitive public marketing in an attempt to derail SAP. Or as one wag said to me: 'Oracle arguing pretty much you need spark plugs in an electric vehicle.' For its own part, SAP would be better off ignoring Oracle, sticking to what it does best and stop feeding the media with more fodder with which to titillate the chattering classes. It can never win those arguments and in any event, they represent the wrong battle ground.

Disclosure: SAP is funding a video project I am undertaking in partnership with Jon Reed to surface interesting developer projects including HANA solutions.

Update: The SAP HANA Effect by Vishal Sikka provides a technical response to Oracle claims.