- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

See the stocks on our ProPicks radar. These strategies gained 19.7% year-to-date.

An Easy Strategy For Hedging 2011 Apple Gains

If you were blessed with enough foresight to buy AAPL earlier in 2011 when it dipped, you probably have a profitable unrealized gain right now. Once again, Apple was one of the best stocks to buy this year for price gains, rising over 24%, from $325.64, to approx. $405.12, as of 12/29/11.

Even though Apple doesn’t currently pay dividends, and isn’t normally part of our coverage of dividend stocks, in last week’s article we wrote about a lucrative, conservative strategy you can use to create your own AAPL dividend that has a higher yield than many high dividend stocks do.

This week’s article details one more way you can create decent income from Apple, and/or, if you now own AAPL shares, you could lock in a good % of 2011’s price gains. With so much uncertainty ahead in 2012 – a US presidential election, ongoing Eurozone debt problems, etc., many forecasters are predicting another volatile year in the market.

Selling Covered Calls is a strategy for hedging some of your downside risk on a stock, that offers you immediate income, and also has tax deferral advantages. Since you only pay taxes on your options gains for the tax year in which the option expires or is closed out, you can often get tax-deferred use of your option income for 1-2 years.

For example, suppose on Jan. 3, 2012, you sell AAPL call options that expire in Jan. 2013. You get paid the call premium within 3 days of the sale, but you don’t have to report this income and pay taxes on it until April 2014, if you let it expire in Jan. 2013.

You can see more info on over 30 high yield Covered Calls trades discussed in our other recent articles in our Covered Calls Table.

Some of the key decisions to make when selling covered call options are:

1. How far out in time to sell covered calls – Generally, the further out in time you sell, the higher the premium, due to the time value of the options. The trade-off, however, is the additional uncertainty of going further out into the future. Currently, there are AAPL options available in 2012-Jan, Feb, March, April, and Oct.; Jan 2013; and Jan 2014. AAPL usually has high options yields and strong volume/liquidity, and there are many options to choose from.

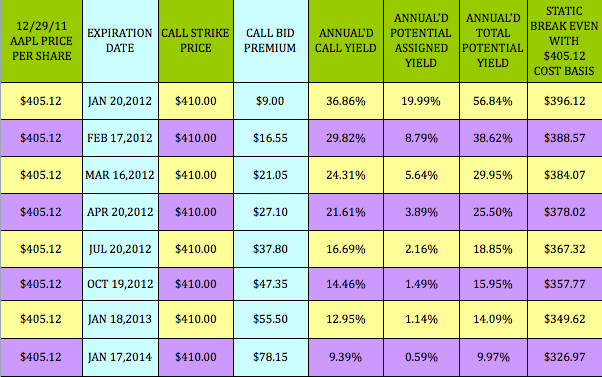

This table below compares the current expiration months, using the same $410.00 strike price, with AAPL’s 12/29/11 price as a cost basis.

Call option premiums increase as you go further out in time, giving you a lower break-even, but a lower annualized yield also:

“Static Break-Even” equals the difference between the stock’s cost of $405.12, and the call bid premium for each month’s strike price. If the stock remains static, (it doesn’t rise above the strike price at or near expiration), then the stock usually doesn’t get assigned/sold away from you. You keep your shares, and move on. If the stock does rise above your strike price, your AAPL shares will get assigned/sold, and you’ll earn an additional profit. (In general, most assignments occur at or near the time of expiration.)

In the above examples, we used a $410.00 strike price, which is $4.88 above the $405.12 cost of AAPL. This represents your potential assigned gain. To calculate your total gain, just add the call bid premium to the potential assigned gain. Ex.) For the March 2012 $410.00 call, you’d receive a $21.05 call bid premium. If AAPL rises higher than the $410.00 strike price, most likely your shares will be sold/assigned, and you’ll also earn an additional $4.88 in price gains, for a total gain of $25.93.

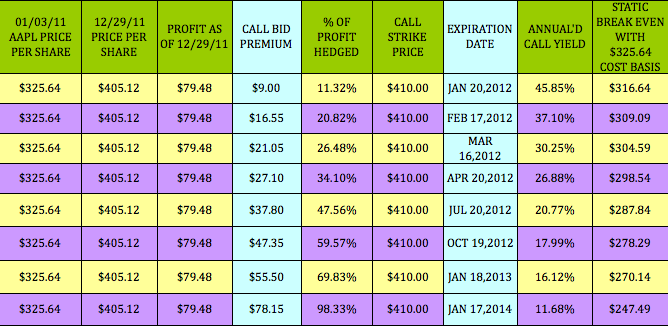

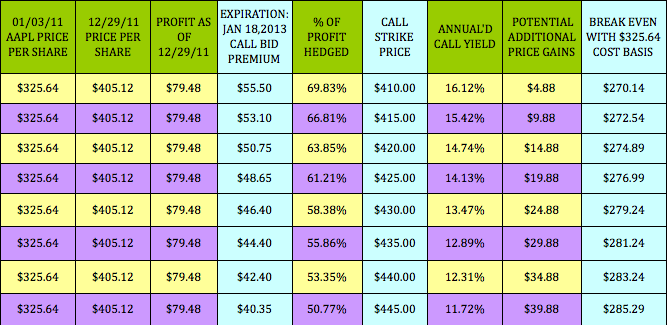

How to hedge your 2011 price gains: The table below uses AAPL’s 1/3/11 $325.64 price as a cost basis, and shows what % of AAPL’s year-to-date 2011 profit you could hedge, via selling $410.00 covered calls in different expiration months. As usual, the further into the future you sell, the higher premium you get, and the more of your profit you hedge, but your annualized yield decreases. (Note: The call bid premium is based upon what the current bid/offer is for each option, as opposed to the ask/sell price. There’s often quite a spread between the two, so you may be able to sell at a higher premium than the current call bid premium):

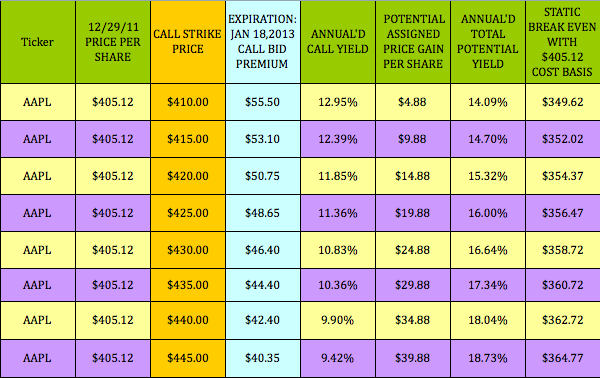

2. Which call option strike price should I sell at – i.e., Should I choose an option strike price closer to, or much higher than the stock’s current price?

Option sellers usually base this decision upon their take on the market, and the stock’s future prospects for price gains. The more bullish you are on a stock, the further “out of the money”, (above the stock’s current price), you may wish to sell calls at. The reason being that, when you sell a call option, you’re obligating yourself to potentially have to sell the stock in the future, at your sold call option’s strike price, no matter how much higher the stock rises. (Note: 1 option contract corresponds to 100 shares of the underlying stock.)

So, if you feel that AAPL might rise far beyond its current $405.00 price, (as do several analysts), you’d probably choose to sell at a higher strike price than a more bearish investor, who is more interested in locking in current price gains, and creating more immediate income, than in speculating on potential future price gains. Indeed, that’s one of the other attractions of selling covered calls, you know exactly what your upside potential and your downside break-even are before you make the trade.

The trade-off is that call options further above the stock’s price, (out of the money), have a lower premium than those closer to the stock’s price, (at the money), or below a stock’s price, (in the money).

Here’s a comparison of various strike prices, using $405.12 as AAPL’s cost basis to further illustrate this point:

Your potential assigned price gain per share increases with each higher strike price. However, your downside break-even price also increases.

The table below compares how much % of year-to-date AAPL profit you can hedge, using different strike prices:

Again, your % of profit hedged declines, as you sell at a higher strike price, but your potential for additional price gains increases $5.00 with each higher strike price, in this example.

A bullish investor might choose a higher strike price for AAPL, leaving himself more potential for additional price gains on top of the current $79.48 year-to-date profit. (The additional price gains are calculated as the difference between $405.12 and the strike price.) A less bullish. or conservative investor may wish to sell at a lower strike price, and hedge more of his year-to-date profit. He’d also have a lower break-even.

Trading Range: If you sold a call at the $420.00 strike price from the table above, your trading range would be:

Max. Price Equivalent of $470.75, ($420.00 strike price plus $50.75 call bid premium), and Downside Break-Even of $274.89, ($325.64 stock cost basis less $50.75 call bid premium).

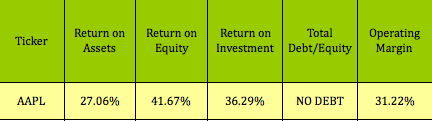

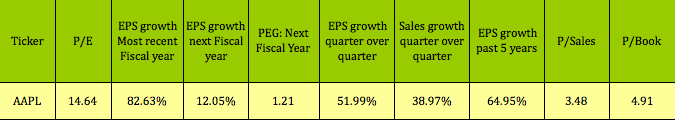

Valuations: Small wonder that AAPL is so popular with institutional and individual investors, when you consider its strong growth has happened during a period of recession and slow economic growth.

Financials: There’s not much to quibble about with AAPL’s financial metrics either, although many AAPL shareholders would like to see the company join other Tech firms, such as Cisco, and enter the ranks of dividend paying stocks. However, for dividend investors, selling covered calls and cash secured puts offer 2 lucrative alternatives for creating income from AAPL.

(Note: You can see details on over 30 high yield Cash Secured Puts trades in our Cash Secured Puts Table.)

Disclosure: Author is short puts of AAPL.

Disclaimer: This article is written for informational purposes only and isn’t intended as investment advice.

Related Articles

We often talk about leadership. Stocks that are leading the market higher. Sectors that are leading the market higher. Indices that are leading the market higher.Why? Because it...

Stocks finished the day lower for a fifth straight day, with the S&P 500 down by 25 bps to close at 5,011. Today is OPEX, and with the passing of OPEX, we will see gamma levels...

While it wasn't the recovery I would have liked, the Russell 2000 (IWM) managed to resist extending its losses. The index did record a loss, and volume was confirmed as...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.