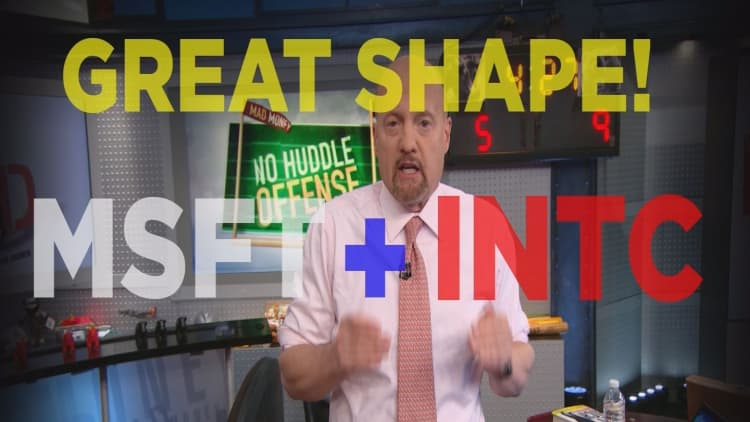

CNBC's Jim Cramer felt like he was transported back to the 1990s when he listened to Microsoft and Intel's post-earnings conference calls on Friday.

"Intel and Microsoft are reigning supreme here," the "Mad Money" host said. "It's eerily reminiscent of the way things were 20 or 30 years ago when both companies struggled to meet the insatiable demand of their [consumers]."

But what made these reports different from the "Wintel" days of the '90s was the central theme: today, it's all about data centers, not personal computers, Cramer said.

Cramer's game plan: How to navigate a confused market

Market-watchers have been on edge in recent weeks with lingering threats of trade wars and the possibility of the market turning negative.

"Anything's possible these days," Cramer said Friday, "but I think that forecast is way too dire."

"This market has morphed into a totally hate-able beast, not a bear, but certainly not a bull," the "Mad Money" host said.

His advice? Look out for buying opportunities into weakness, but be prepared to sell into strength as the economic environment remains uncertain.

With that in mind, Cramer went over his game plan for the coming week, with earnings from Apple, BP and other top companies.

Apple has more to lose with tariffs

If a trade war breaks out, companies like Apple and Walmart will be caught in the crossfire, but Apple has the most to lose, CNBC's Jim Cramer argued on Friday.

"You can't crack down on China without hurting large swaths of the American economy," the "Mad Money" host said. "Why? because China's our biggest trading partner."

While both companies have a substantial base in the People's Republic — 10 percent of Walmart's business is in China, as is 20 percent of Apple's — Cramer said Apple is the most vulnerable.

As many of Apple's products are assembled in China, this move could cause disruptions to the supply chain and could spur other penalties such as boycotts.

Centene CEO: Either grow or get paid to stay the same

Centene, a company that provides a portfolio of services to government-sponsored health care programs, like Medicaid and Medicare, is continuing to grow, with new products and additional states in its programs.

"We're going to have probably a $65 billion run rate when this thing all gets closed, up from $48 billion last year," Centene CEO Michael Neidorff told Cramer in a Friday interview.

"You either grow or get paid a whole lot more for staying the same. And we want to grow," the CEO said.

The company beat expectations with its Tuesday earnings report, delivering a 29-cent beat off of a $1.88 basis. Revenue was slightly weaker than expected, but still up 12.5 percent year over year.

Cramer also pointed out that the company doesn't have to worry about commodity prices, doesn't have exposure to China and is "exactly the kind of stock that can work if you're concerned about an economy that might be losing steam."

Briggs & Stratton CEO talks long-term growth

The world's largest producer of gasoline engines posted earnings on Wednesday, delivering a 1-cent earnings beat off of an 83-cent basis and revenue up just 1.2 percent year over year.

But management cut their full-year guidance across the board, offering reduced estimates on revenue, margins and earnings for the coming quarters. Shares quickly fell about 11 percent on Thursday, regaining some of the losses during Friday's session. Investors were not happy.

"It was pretty darn disappointing," Cramer said.

But in a Friday interview with Cramer, Briggs & Stratton CEO Todd Teske said the company has a good long-term strategy with solid fundamentals.

"There's some tailwinds that we start to see coming down the pipe with housing and that sort of thing, so there's a lot to be optimistic about," Teske said on Friday. "It's just you get into one of these quarters where things didn't quite work out in terms of the guidance that we had to give."

Lightning round: Opportunity in T?

In Cramer's lightning round, he zoomed through his take on some callers' favorite stocks:

AT&T: "Look, AT&T is, actually, I think, putting in a bottom because people are buying stocks [of] domestic companies that have high yields where the cash flow's good and I think that's ATT."

New York Community Bancorp: "It's too risky for me, sir. It's too risky. I think we've got some great American banks, the largest ones, that have been acting terribly but are worth a great deal, so I'd rather have you in one of those."

Disclosure: Cramer's charitable trust owns shares of Amazon, Apple, DowDuPont and Microsoft.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com