10% of Q1 Revenue: Cryptocurrency Mining Boosts AMD Profits Despite Volatility

Advanced Micro Devices’ first-quarter earnings results were buoyed by cryptocurrency mining revenue, but the chipmaker warned the volatility is getting in the way.

AMD in Q1 generated a higher percentage of its revenue from sales of its graphics chips that are used to power computers in the cryptocurrency mining process for digital currencies like bitcoin and ethereum.

The company, however, is bracing for a “modest decline” in blockchain-fueled revenue in the second quarter even as bitcoin has turned a corner. Nonetheless, AMD CEO Lisa Su expects mining demand will be around for the long term.

“I do think the blockchain infrastructure is here to stay. I think there are numerous currencies. There are numerous applications that are using the blockchain technology,” said Su on the earnings call.

The Results

AMD’s Q1 computing and graphics revenue came in at $1.12 billion, soaring 95% versus last year in the same quarter. The company attributes this to “strong sales of both Radeon and Ryzen products.”

“The strength in Radeon products was driven by both gaming and blockchain demand. We believe blockchain was approximately 10% of AMD revenue in Q1 2018,” said AMD’s CFO Devinder Kumar on the earnings call.

AMD’s Su described on the call how sales “outperformed seasonality,” thanks in large part to rising blockchain demand tied to the company’s Radeon Vega and 500 series graphics cards sales.

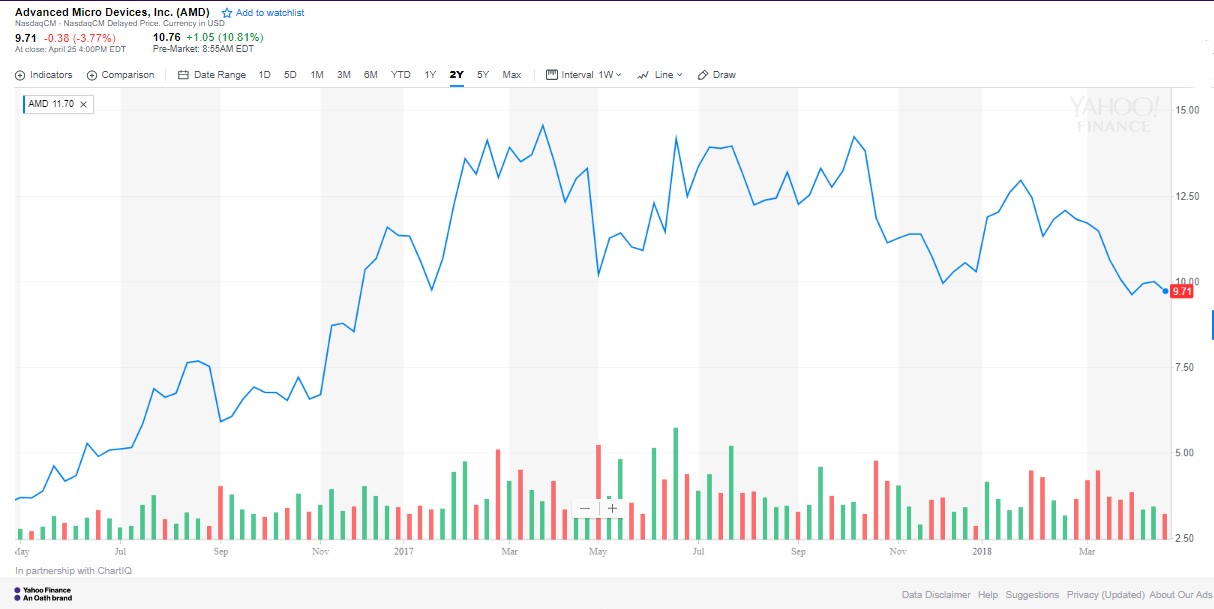

AMD’s stock has soared more than 250% in the past two years amid rising demand for its graphics processors.

‘Modest Decline’

AMD also provided guidance for its second quarter performance, cautioning investors to scale back their expectations for blockchain demand. Nonetheless, the guidance surpassed Wall Street analysts’ expectations.

“On a sequential basis, we expect Q2 revenue to benefit from continued strength in our Ryzen and EPYC product families and a seasonal increase in semi-custom revenue, partially offset by a modest decline in graphics due to blockchain,” said Su.

AMD also provided guidance for full-year 2018 saying “based on the strength of our business momentum … we now expect revenue to increase by mid-20’s percent over 2017, driven by the ramp of our new products. Blockchain revenue to be mid- to high-single digit percentage of revenue for 2018.”

Anecdotal Evidence

AMD’s Su pointed out that there was a “lot of discussion” surrounding blockchain and cryptocurrency mining, noting that the management team “spends time” with their customers, including commercial miners. Su described how AMD has greater “visibility” into the demand for the commercial miners versus individual cryptocurrency miners, the latter of whom has a shared use-case between gaming and mining.

Su pointed to the volatility inherent in this market as the reason for the more modest expectations for blockchain demand in the second quarter.

Featured image from Shutterstock.