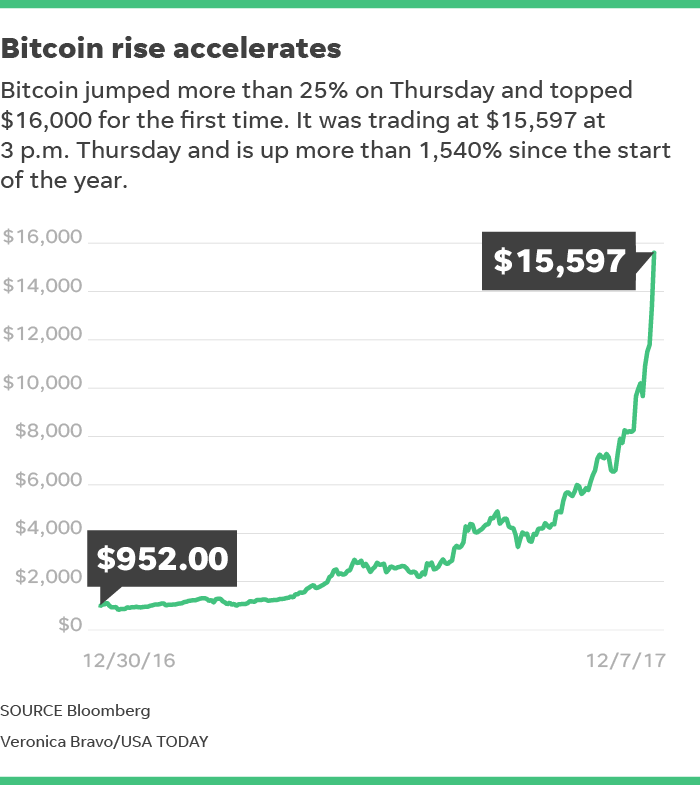

Bitcoin tops $16,000, and its $271B market value passes Home Depot's

Adam Shell

Adam ShellThe Bitcoin gold rush accelerated Thursday as the world's best-known digital currency barreled through $14,000, $15,000 and $16,000 in an extraordinary price run-up that now values the cryptocurrency at $271 billion, eclipsing Home Depot's market worth.

Bitcoin's surge — which many Wall Street pros claim is a speculative frenzy and financial bubble — has boosted the digital currency's market value so much that it's now worth more than 488 of the 500 U.S. companies in the Standard & Poor's 500 stock index. So, only 12 companies in the large-cap stock index have market values greater than Bitcoin, S&P Dow Jones Indices data through Dec. 6 show.

At its peak Thursday, Bitcoin jumped more than 25%, rallying $3,325 and hitting an intraday record of $16,568.92 per coin, just eight days after topping $10,000. At 4 p.m. it remained up more than 19% at $15,804. For the year, Bitcoin has surged more than 1,550%.

From its low of $11,450 on Tuesday to its peak Thursday, Bitcoin rallied 45% in a roughly 48-hour span. There are now 16.73 million in circulation, according to coinmarketcap.com. Bitcoin's market value is simply the number of coins out in the market times its price, which is constantly shifting.

The meteoric rise has caught the attention of Wall Street, which marvels at its steep and quick surge but fears the mania will end badly.

Jim Cramer, host of CNBC's investment show Mad Money, called Bitcoin's most recent spike "parabolic" and compared it to a rocket just after launch.

"It has a Cape Canaveral feel," Cramer said Thursday morning on the cable business channel, referring to the well-known Florida rocket launch site. "Maybe Bitcoin is going to Mars. Or Jupiter."

But there's a growing chorus of Bitcoin watchers warning investors to steer clear of the surging cryptocurrency, despite the lure of quick riches.

"It’s difficult to see anything move as Bitcoin has and not fear a devastating bubble bursting," warned Craig Erlam, senior market analyst at OANDA, a New York-based foreign exchange firm. "If speculation is playing as big a role in the latest moves as some suspect, then very interesting times may lie ahead."

But Erlam says Bitcoin could rise a lot more "before the bubble bursts."

More:What's Bitcoin exactly, and should I invest in it?

More:Bitcoin's big swing at $11,000 launches renewed talk of bubble

More:Bitcoin's speculative fever makes rally in stocks look tame

Bitcoin backers view it as a currency and payment system of the future as well as a new kind of investment. They say it's an emerging alternative to the dollar, euro and yen and an investment such as gold, stocks or bonds.

Skeptics say Bitcoin is impossible to value, wildly volatile and a speculative play that may never gain widespread acceptance.

The bullish thesis has gotten a boost in recent weeks after a U.S. security regulator gave the OK for options exchanges to launch bitcoin futures.

Sunday, the Chicago Board Options Exchange is set to become the first regulated U.S. exchange to offer Bitcoin futures trading. The move is seen as helping legitimize Bitcoin and paving the way for greater acceptance from large institutional investors.

Another plank in the bull's case is that there will be a limited number — 21 million — of Bitcoins created.

Bitcoin works off blockchain technology, akin to an anonymous digital ledger that is not regulated by any government or financial institution.

Bitcoin, which is now valued at $270.6 billion, according to coinmarketcap.com, is nearly one-third the value of Apple, the world's most valuable company, which was worth $867.8 billion as of Wednesday's close, according to S&P Dow Jones Indices.

The cryptocurrency is fast-approaching the value of Walmart, which is $288.2 billion, and could soon eclipse Wells Fargo, currently $288.4 billion, and Bank of America, now at $298.7 billion. Bitcoin could overtake these iconic American companies if the momentum rally continues.

"The Bitcoin rush is not over," Yann Quelenn, analyst at Swissquote Bank, an online bank in Switzerland, told USA TODAY via email. "Sheer greed is driving the cryptocurrency higher, perhaps to $20,000 by Christmas."

Bitcoin is wildly volatile. Already this year, it has had enjoyed six bull markets (or gains of 20% off of lows) and five bear markets (or drops of 20% from peaks).

Thursday's trading was turbulent, with Bitcoin climbing more than 25% to its intraday peak but then tumbling nearly $1,700, or 10%, before closing at $15,804, or 4.6% off its high.

Quelenn warns of a massive hangover after the party ends.

"Bitcoin is unique in history, but a (steep price) correction will likely be very tough," he says.