This past week saw both Twitter and Facebook sign deals with recently-launched sports network Stadium for live coverage of various college sports. Both companies had earlier signed TV streaming deals for a number of other bits and pieces of sports content, none of them particularly compelling. In a world where sports content is one of the few slices of live TV still holding up reasonably well as viewing shifts to on-demand and streaming, why aren’t these companies buying more interesting stuff? The answer lies largely in the long-term deals signed by the major sports leagues in the US.

Recent Sports Rights Deals for Tech Companies Are Mostly Sub-Par

Twitter and Facebook’s Stadium deals are far from the only ones they or other tech companies have signed over the last couple of years. This year in particular has seen a big increase in investment by these companies as they look to fill their rosters of live video content and Twitter in particular tries to deliver on its commitment to have 24/7 live streaming video on its site. Some other examples include:

- Facebook signed a deal with Major League Soccer and Spanish-language broadcaster Univision, another deal with the NBA’s D-League (the minor league of the NBA), showed pre-Olympic basketball exhibition games in summer 2016, will show 20 live MLB baseball games in the 2016/17 season on Friday nights, and secured rights for a number of second-tier European soccer tournament games for the 2017-2018 season, as well as over 5000 hours of e-sports content.

- Twitter won the 2016-2017 deal to stream Thursday night NFL games online (a deal lost to Amazon this year), but other than that has mostly had content of less interest to most viewers, with few exceptions: the Wimbledon tennis tournament was another highlight, but it has also signed deals with the WNBA, the PGA Tour, and various other sports including lacrosse.

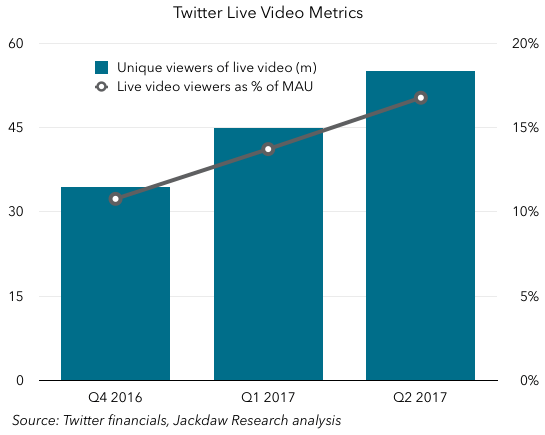

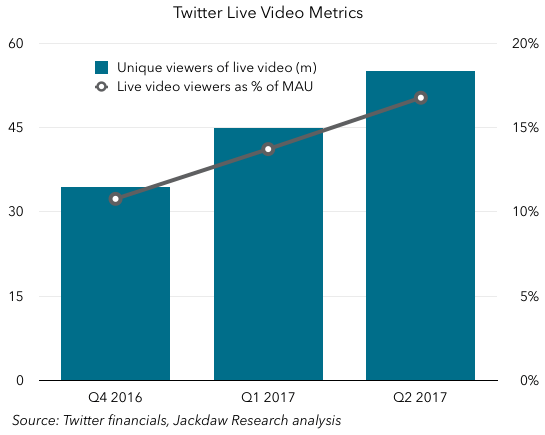

To be clear, there is an audience for each of these sporting events that these companies are carrying, but the vast majority of it sits outside of the sports that actually drive live viewing in meaningful numbers. Facebook’s live video metrics have all been vague and relative, so we have no way of measuring its success in absolute terms, but Twitter has provided the number of unique live video viewers each quarter, as shown in the chart below:

As you can see, the number of live video viewers has grown over time, but in Q2 it was just 17% of its total monthly active users, meaning that over 80% of its monthly active users never even watched any live video at all. Of that 17%, it’s entirely possible that many simply watched a few seconds, so the number that actively engaged and watched any meaningful amount of live video is likely far smaller still.

The Best Rights are All Locked Up for Years

Why, then, do Facebook and Twitter bother with these sub-par sports rights that drive little viewing? The simple answer is that the rights that might actually drive meaningful engagement are almost all locked up for years. The table below shows a summary view of the US TV rights for the four major sports leagues in the US, some of which are sliced and diced in many different ways, with the rest allocated more simply:

As you can see, Major League Baseball, the National Hockey League, and the NBA are all locked up until at least 2021, with most of the NFL rights packages also locked up for almost as long. The NBA won’t be available to new bidders until the 2025 season. This is why the tech companies – notably Facebook and Twitter – have been acquiring so many other rights: because they’re the only ones available. No matter how much these companies are willing to spend, they simply can’t get significant access to the major sports people actually watch in the US.

The one exception to all this has been the NFL’s Thursday Night Football package, which has had separate broadcast and digital rights deals for the last couple of years. Twitter won that deal for the 2016/17 season, but lost it this year to Amazon, which is likely to be another big bidder for sports rights in the next few years. Verizon, meanwhile, has the unique mobile rights to NFL games, which detracts from every other digital football package out there, but that deal will expire in 2018, so it will be interesting to see what happens then.

Two More Years of Dealing in Marginal Sports Content

All of this means we likely have two more years of tech companies mostly dealing in the same marginal sports content we’ve seen so far from them, grabbing a few games here and there from the major leagues, and then securing broader rights to sports of less interest to the mainstream US user. But a couple of years from now, as some of the rights negotiations for big deals starting with the 2021 season begin, I would expect a number of big tech companies, including not just Facebook and Twitter but also Amazon, Google, and Apple, to be major bidders and likely secure some big packages which have hitherto all been captured by broadcasters and cable operators.

In the meantime, the main focus for most of these companies will have to be on video content other than sports, meaning commissioning both scripted and unscripted shows or acquiring those being shopped around, and the investment in original content in particular will continue to grow, with Apple apparently spending a billion dollars this year, Netflix spending $7 billion, and others like HBO, Hulu, Amazon, and others spending somewhere in-between those figures. For now, that’s the only thing these companies can do, and it’s going to mean that the prices of content go up and there’s eventually a glut of video on the market, until such a point as the legacy TV industry starts reducing its spend in the face of accelerating cord cutting and cord shaving.

For those interested in sports betting, the Premier League US Sports betting offers a captivating arena. Given its unpredictable nature, it offers great opportunities for sports enthusiasts aiming to capitalize.

Before you lay down your bets, make sure to research team form, injuries, and head-to-head records. This data is often key to successful wagering.

Joining forums can provide useful tips and insights from veteran punters. Feel free to contribute your own thoughts and betting strategies, as exchanging information improves your chances.

Keep in mind, though betting on the Premier League is exciting, practicing responsible gambling is crucial. Only wager what you can afford to lose and look for assistance if gambling becomes a problem.

I am genuinely thankful to the owner of this web page who has shared this

fantastic article at at this place.

Разнообразието на нашите дрехи за деца е невероятно! От весели принтове до интересни акценти, имаме нещо за всяко дете. Независимо дали търсите удобни дрехи за игра или елегантни тоалети за специални случаи, нашите облекла са перфектни за всякакви приключения. Разгледайте нашите колекции днес детски комплект и впечатлете всички с необикновения си вкус.

Онлайн магазин за качествени детски и бебешки дрехи-внос от Турция и от български производители. Магазинът предлага ежедневни и официални детски дрехи за …