Tech wreck gives life to bull market's forgotten stocks

Wall Street’s 8-year-old bull market has sent a message to Facebook, Apple and the rest of the mega-popular tech FAANG stocks: I can get along without you.

When the “tech wreck” hit on June 9, investment pros wondered whether the falling prices of the mightiest stocks on Wall Street would bring down the entire market. If increasingly expensive superstars like Facebook, Apple, Amazon, Netflix and Google-parent Alphabet – the companies that had been generating big gains in 2017 -- weren’t working anymore, wouldn’t that spell trouble for a market that had grown overly reliant on them? Would FAANG’s troubles mark the start of a broader retreat from stocks?

Those fears have proved unfounded. The Dow Jones industrial average has notched five record highs in the seven trading sessions since tech took its big hit, including another record on Monday, a day that also saw the tech sector rebound 1.7%, its biggest one-day gain since December. The broader Standard & Poor's 500 stock index also climbed back into record territory. This despite a nearly 4% decline for tech over the six trading days heading into this week.

“It’s a clear sign that we are not in an all or nothing market,” said Andrew Adams, a market strategist at St. Petersburg, Fla.-based investment firm Raymond James.

The tech tumble began after a Goldman Sachs note questioned whether investors were treating FAANG names too much like more stable stocks, such as utilities and companies that sell staples like toilet tissue, soda and toothpaste. Adding to the concern last week were critical analyst reports on Apple and Google that resulted in price downgrades over fears that the stocks had grown too expensive.

But the bull, it turns out, is more resilient than expected. And it may be even healthier following the tech selloff, Wall Street pros say.

Instead of getting out of stocks, many investors sold tech shares and redirected their cash to other parts of the market, a tactic known as “market rotation.” The cash flowing to stocks that had been largely ignored provides support for them and allows them to gain strength and move higher.

“The rotation part is key, that is how bull markets keep going,” said Todd Sohn, a technical analyst at Strategas Research Partners, a Wall Street research firm.

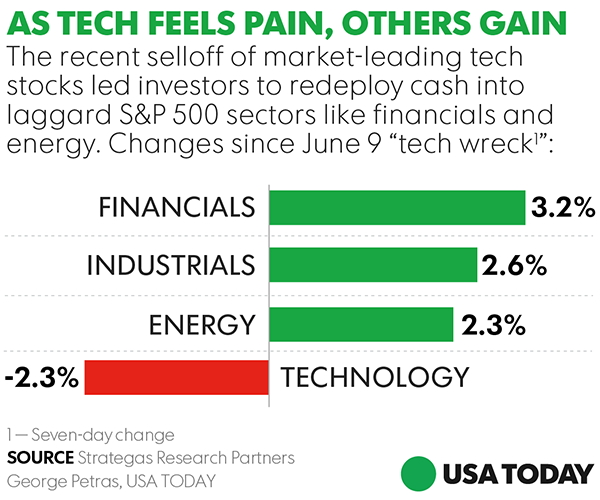

While the S&P 500 tech sector has slid 2.3% the past seven trading sessions (tech was down 4% heading into Monday), previously poor-performing financial stocks have rallied 3.2%, industrial companies have jumped 2.6%, and the lagging energy sector has risen 2.3% according to data from Strategas Research Partners.

In another sign of market strength, the number of stocks moving up compared with shares moving lower – the so-called “advanced-decline” line – has climbed to fresh highs, Strategas data show. That is a sign that the “average” less-glamorous stock is rising in value. It also shows that the rally is being driven by many different types of stocks from a variety of industry groups.

Financial stocks are benefiting from other factors, as well. The Federal Reserve last Wednesday increased short-term interest rates for the second time this year and plans on hiking rates a third time. Higher rates boost profit because banks earn more on the money they lend out than what they pay out in interest on deposits.

Banks are also seen benefiting from the Trump administration's possible rollback of key provisions of the Dodd-Frank financial reform act. Changes could include less stringent capital requirements for big banks and more relaxed lending standards for smaller lenders.

Energy shares, which have stumbled this year amid fresh concerns about a global oil glut, are seeing renewed interest from buyers. Bargain hunters are enticed by lower share prices as well as by a huge earnings rebound. The energy sector grew earnings at a 665% clip in the first three months of 2017 and are seen growing profits at a nearly 700% clip in the second quarter. That represents a huge rebound following years of plunging crude prices.

Another upbeat trend for the broader market: Many stocks this year have gone up a lot more than the FAANG names, according to Strategas data. There are 40 stocks in the S&P 500 index that have posted better year-to-date gains through Monday's close than all five FAANGs.

Biotech drugmaker Vertex Pharmaceuticals is the best-performing stock in the index, up 71%; film and TV distributor Activision Blizzard is second-best at 67% and Wynn Resorts is next with a gain of 60%. Social media giant Facebook is the best-performing FAANG stock with a 32.9% gain -- which makes it only the 41st best-performing in the S&P 500.

“This market is not just all tech,” said Wayne Wicker, chief investment officer at ICMA–RC.

The fact the market has held up since the tech downdraft is a good sign, he said. “It’s not like investors are heading to the exits.”

The question now is whether the money flowing into other stocks and sectors will continue, said Gary Kaltbaum, president of Kaltbaum Capital Management. "Time will tell," he said.