Why Samsung's Harman purchase will be seen as Apple blunder decades from now

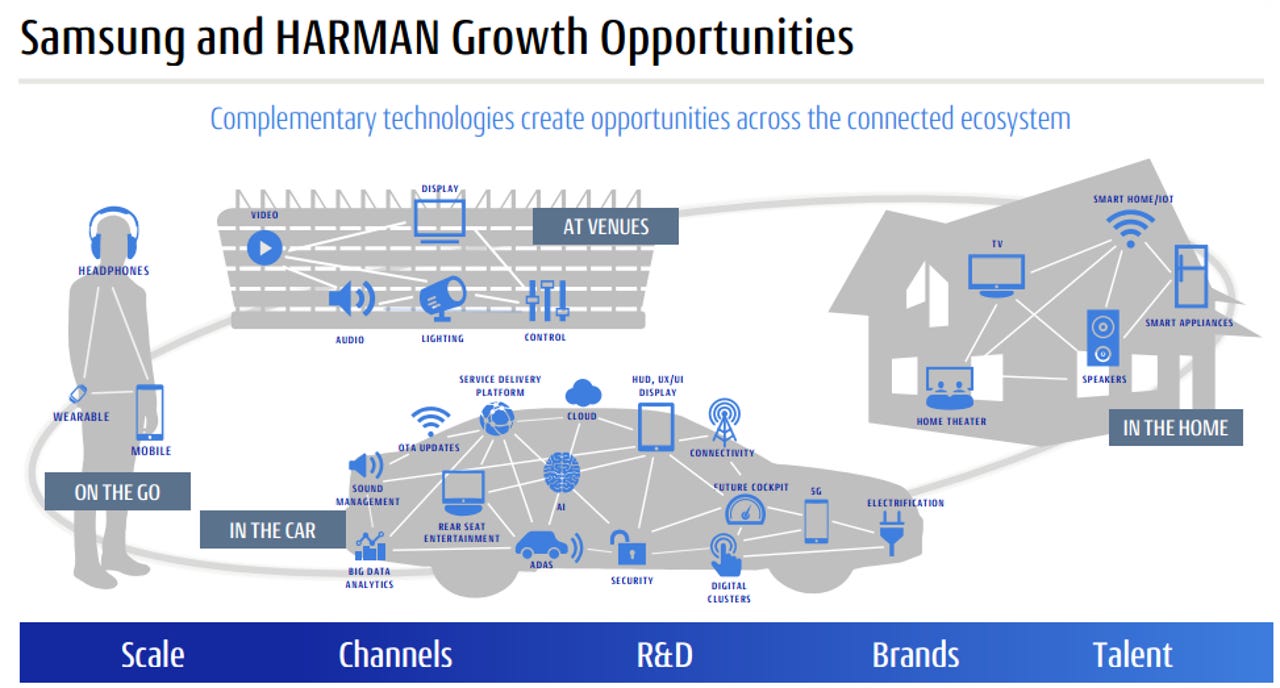

Samsung's purchase of Harman is strategically sound, worth the $8 billion, and positions Samsung well in the connected car market. Meanwhile, Samsung diversifies from a saturated smartphone market.

The deal makes so much sense you have to wonder why Apple didn't buy Harman.

There has been an argument floated for months if not years that Apple should use some of its cash to acquire Harman. The crux of the case, outlined by Jim Cramer repeatedly, is that Apple could diversify and become the hub of the connected car.

Not surprisingly, Samsung basically took the same argument Apple would use for purchasing Harman and adopted it.

- Samsung will immediately gain a significant share of automotive electronics.

- Connected car hardware and software represented 65 percent of Harman's $7 billion in annual sales.

- Samsung can vertically integrate its processors and displays with Harman.

- The bridges from the connected car to smart homes and cities aren't fully formed, but inevitable.

- Samsung's B2B unit is likely to get a boost with Harman for stadium, concert and performance facilities via new implementations.

- The internet of things market is a key area where Samsung can leverage the convergence of hardware software and data.

Add it up and Samsung's purchase of Harman makes a ton of sense. And I'm usually a glass half empty type when it comes to big acquisitions.

What this tells me about the strategic landscape in the connected everything market:

Google has Android Auto and plenty of connected car ventures, but the reality is that it's distracted with science projects like self-driving vehicles.

Apple has had issues with its own car dreams, but let's face it: The company is largely following Google. Apple's iOS will play a role in the vehicle, but it won't be a native experience. Apple's car fortunes will go as the iPhone does. Richard Windsor, Edison Investment Research analyst, said:

Apple's realignment of its automotive experiment is a strong indication of how it is not a good idea for a tech company to start making cars and we do not think that Samsung ever had any intention of following Apple down this road. Most importantly, Samsung does not represent the same threat to automotive brands that Apple and Google do, as it long ago gave up trying to compete in the ecosystem.

BlackBerry's QNX is likely winner here. QNX serves as the middleware to a lot of connected car efforts--see Ford Sync for instance. QNX's role as a neutral and secure platform in the vehicle will play well with Samsung/Harman.

Microsoft's platform play revolves around Azure and partnering with key players. Sure Samsung and Microsoft may make strange bedfellows in some areas, but overall will remain good partners.

What's telling in all of Samsung's comments and slides about the Harman purchase is that you could easily do a global search and replace with the word "Apple" and the strategy makes sense. Assuming Samsung doesn't completely botch the Harman purchase, Apple may regret not beating its rival to the punch.